Some ideas are so big they open up a new sector for investors. That’s the case with 5G technology.

But investing in 5G is not the same as investing in tech stocks, or even specific niches like entertainment stocks, or streaming stocks. In fact, investing in 5G stocks is like investing in all of the above and then some. That’s because this fifth generation of wireless technology is more than just faster speeds and improved latency between devices.

Key Points

- By 2025, 5G will cover two-thirds of the world.

- The 5G revolution rollout phase continues — operators have started adding capacity again at a higher rate.

- The bear market plunge means opportunities could exist for investing in 5G stocks.

- 5 stocks we like better than Activision Blizzard

By now, you’ve likely heard the term “5G wireless” a number of times. Telephone carrier ads everywhere tout the superiority of their 5G network. In fact, you may have already upgraded to a 5G smartphone but may not notice the difference. Your 5G phone may still operate on a 4G network since your geographical area may not yet support 5G.

However, by 2025, 5G will cover two-thirds of the world, according to Ericsson. We are still in the rollout phase of the 5G revolution — operators have started adding capacity again at a higher rate. The tech stocks bear market plunge means opportunities still exist for those interested in investing in 5G stocks.

By the time you’re finished with this article, you’ll walk away with a better understanding of the 5G industry and key 5G stocks to invest in, including how to invest in 5G. We'll also highlight some of the many subsectors that can allow investors to profit from 5G either as pure plays or as derivative investments.

What is 5G Technology?

Before you start committing your investment capital to buy 5G stocks, it’s important to know what you’re investing in.

5G stands for the fifth generation of wireless technology. A key term to understand in terms of 5G is latency. This is the time it takes for a device to make an input for data (a request) and the network’s response. Every generation has narrowed the latency between this input and response.

This latency presents itself to consumers as increased speed. But in this case, it’s faster speed that will help drive growth in emerging fields such as artificial intelligence. This is playing out in fields such as autonomous driving, cryptocurrency mining, and an enhancement of the Internet of Things (IoT).

You can look at it another way. The migration of wireless technology to this point has been mostly about benefits to individual users. The emergence of 5G technology will deliver massive benefits to businesses and the country’s infrastructure.

Why Invest in 5G?

The reason to invest in anything is to reap profits from the potential upside. We’re still in the early innings of mainstream 5G penetration — its coverage only reached 25% of the population by the end of 2021. Now, nearly 60% of new smartphones are 5G-enabled.

Mass market adoption should happen by 2025, when 5G will cover two-thirds of the world, according to Ericsson. 5G offers a platform for innovation and efficiency, enhances current applications and opens up the doorway to a multitude of new technologies and applications.

Qualcomm estimates 5G will enable up to $13.1 trillion in global sales activity by 2035. The initial 5G hype has seen its peak and collapse. The pandemic sped up e-commerce and wireless broadband usage by years to accelerate the move toward mass 5G and to handle capacity. We are now in the adoption and immersion stage, where consumers and businesses can gain access to and use 5G.

A resurgence in 5G interest and investment has inflated despite the current uncertain economic environment.

Ways to Invest in 5G

Ways to Invest in 5G

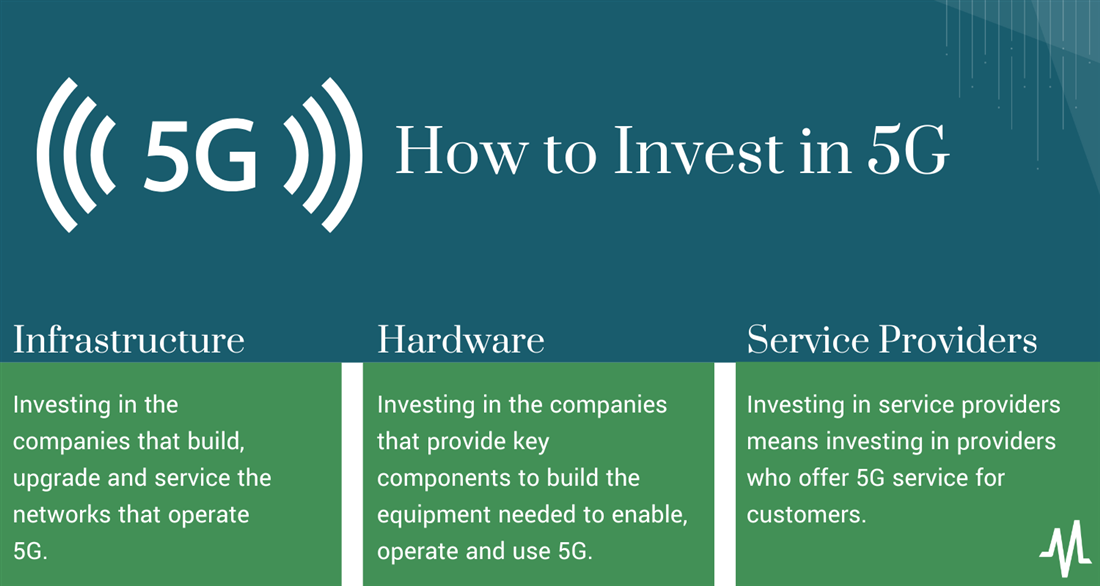

You can consider three areas of investment in 5G: infrastructure, hardware and service providers. Improved applications are the indirect benefactors of 5G. For example, Apple’s iPhone 14 has 5G capabilities but an investment in Apple Inc. (NASDAQ: AAPL) isn’t a direct investment in 5G.

5G stocks are down in 2022 due to the downward trend in the U.S. equity markets. Is this a glass half-full scenario? Possibly, since a larger drop in the share price can offer a larger annual dividend yield and more upside potential when the stock market recovers.

Infrastructure

Investing in infrastructure entails investing in the companies that build, upgrade and service the networks that operate 5G. Service providers can band-aid capacity by upgrading existing 4G networks while building out its radio access network (RAN) towers and small-cell base stations needed for true standalone 5G. Infrastructure also involves bidding for higher spectrum bands in auctions.

Hardware

Investing in hardware means investing in the companies that provide key components to build the equipment needed to enable, operate and use 5G. You can invest in the companies that make the mobile semiconductors or wireless chipsets needed for consumers to use 5G service, which can range switch providers, routers and optical fibers to the various semiconductor companies that handle that supply the processors for 5G usage.

Service Providers

Service providers provide 5G service for customers. They are telecommunication and broadband wireless providers who actually operate the networks. The companies may own or lease the actual network towers but provide the access to use 5G service and enable consumers and businesses to operate 5G-enabled devices.

Why Does 5G Create a Different Opportunity for Investors?

The first two generations of wireless technology (1G ad 2G) allowed wireless communication by way of voice, text (SMS) and multimedia messaging services (MMS).

The launch of 3G around the year 2000 enabled the smartphone revolution. 3G increased the network bandwidth and provided transfer rates that allowed internet applications (apps) and audio and video files. When it first launched, it was revolutionary with the ability to download apps in approximately one minute.

About 10 years after 3G was introduced, the fourth generation (4G) arrived. This is referred to as both 4G and 4G LTE. The improved latency allowed for faster uploads. This enabled streaming music and video.

The progression from 1G through 4G did not require a significant change in infrastructure. But that is not the case with 5G. And that is creating a broader opportunity for investors.

Top Companies Involved in 5G

The transition from 3G to 4G was primarily about telecom stocks like Verizon Communications Inc. (NYSE: VZ) and AT&T (NYSE: T). Verizon's 5G nationwide mobile network is available in over 2,700 cities as it continues to expand its network. Its 5G ultra-wideband network uses high band (mmWave) and mid-band (C-band) spectrum with speeds up to 10x faster than its nationwide network. 5G phones that step out of the coverage area automatically shift to 4G LTE mode.

AT&T is the nation’s largest wireless provider with 44.8% of the country’s wireless subscriptions and telecommunications, media and technical services worldwide.

It offers a range of devices and service plans and leads the switch to 5G. Its 5G service comes in three tiers that unlock the full potential of the technology. The base AT&T 5G uses the low band for wider coverage and can reach 281 million people in 22,000 cities. The high-end 5G+ uses millimeter wavelength and reaches 45 major metropolitan areas, stadiums and other high-traffic areas. The 5G+ with C-band offers high speed and wide coverage.

However, with the advent of 4G, investors also could invest in streaming stocks such as Netflix Inc. (NASDAQ: NFLX) and, more recently, Roku Inc. (NASDAQ: ROKU).

With 5G investors have even more diversification. As we mentioned above, investors have multiple segments in which to invest. As the 5G infrastructure matures, investors have the option to shift assets to other companies to help maximize their gain.

Here are just a few of the sectors that look to gain from 5G technology:

- Semiconductors: Like most things tech, the building blocks of 5G are found in the tiny computer chips that allow processors to calculate data and execute commands. Companies like Qualcomm (NASDAQ: QCOM), Nvidia Co. (NASDAQ: NVDA) and Skyworks Solutions Inc. (NASDAQ: SWKS) are just a few of the leading companies in this subsector. Skyworks Solutions provides analog semiconductors optimized for next-gen 5G wireless infrastructure applications. It supplies chips for front-end modules and radio frequency systems. It is Apple’s 5G iPhone RF front supplier. Smartphone sales have slumped Skyworks’ stock price but 5G tailwinds could boost up due to capacity and content growth. It also has the potential for growth in China’s electric vehicle (EV) market as it supplies RF expertise to MediaTek platforms as 5G connectivity gets adopted.

- Equipment and infrastructure: Before wireless signals reach connected devices; they have to pass through a network of basic hardware including fiber optic wires. Although this network is invisible to consumers, it’s vital to enabling 5G. Some of the companies to look at in this area include Corning Inc. (NYSE: GLW) and Ciena Co. (NYSE: CIEN).

- Real Estate Investment Trusts (REITs): 5G requires a new network of mini towers and other fixed-in-place assets. This is creating opportunities for REITS that own and operate the core real estate holdings that are needed to expand the 5G network. Companies such as American Tower (NYSE: AMT) and Crown Castle (NYSE: CCI), leaders in this subsector, which are primarily income investments because of their requirement to pay out a high percentage of their profits to shareholders. However, due to the 5G buildout, these companies also reward their investors with a fair amount of growth.

- Telecom: Like the prior generations of wireless technology, the companies that provide phone, internet, and television services via 5G are among the best pure plays in the sector.

- Streaming services: This was a category that was essentially created by the emergence of 4G and will only become more entrenched with the debut of 5G technology. Netflix is an obvious choice here. But even a blue-chip company like The Walt Disney Company (NYSE: DIS) has become a major player in the streaming space. This isn’t a pure play on 5G, but these companies stand to benefit from the widespread adaptation of 5G.

- Media companies: Related to streaming services, media companies are creating films, music and other programming. And along with traditional media companies, social media companies will also benefit from 5G technology.

- Video games: The gaming sector will be a big winner of the 5G revolution. Names like Activision Blizzard Inc. (NASDAQ: ATVI) and Electronic Arts Inc. (NASDAQ: EA) may stand to benefit from increased demand.

- Cloud computing: 5G will enable faster and easier communication with cloud platforms. This will be a benefit to companies like Amazon.com Inc. (NASDAQ: AMZN) and Microsoft Corporation (NASDAQ: MSFT). Investing in cloud computing stocks is not a pure play on 5G.

- Healthcare: If you’ve visited a doctor these days, there’s a better-than-average chance that you did so in a virtual setting. 5G will help ensure that telehealth will continue to grow. Healthcare will also be a beneficiary of advances in virtual reality and artificial intelligence.

You may recognize some or all of the companies involved in multiple areas of broadband, information technology and cellular networks on this list. When investing, consider the other complementary products and services these top companies provide and do your research on their latest earnings reports and financial metrics. These companies cover the areas of investment that include infrastructure, semiconductors and service providers.

Telefonaktiebolaget LM Ericsson

Stockholm-based Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC) is a multinational network telecommunications company that provides infrastructure and networking services in over 180 countries worldwide. It has grown a portfolio of more than 40,000 patents. The company made a major pivot in its business from selling cheap cellphone handsets to leading the network transformation trends. Its 5G intellectual property (IP) portfolio helps it provide an end-to-end 5G network buildout solution by upgrading existing networks.

Ericsson has contracts with the largest telecom providers in the world, from a $3.5 billion deal with T-Mobile US (NASDAQ: TMUS) to Verizon Communications Inc. (NYSE: VZ) choosing the company in 2017 for its fixed 5G network rollout. Ericsson also built 65% of the AT&T 4G mobile network.

The company has grown its RAN market share from 33% in 2017 to 39% in Q3 2022 and signed “significant” contracts with further increased geographic footprints in its Q3 2022 earnings.

Nokia Oyj

Finland-based Nokia Oyj (NYSE: NOK) provides products and services for RAN, covering 2G to 5G technologies. The company has benefited from the strong U.S. dollar versus the euro as it generates much of its income in dollars while expenses are denominated in euros.

The company continues to invest in 5G infrastructure; operators continue to add capacity at a higher rate. Notable wins include a contract for 45% of India-based Bharti Airtel’s planned 5G network and selection by India's largest mobile carrier, Reliance Jio, as its 5G equipment provider. NOK tends to draw more interest when shares fall under $5.

T-Mobile US

T-Mobile US (NASDAQ: TMUS) is the nation’s fourth-largest wireless carrier. T-Mobile has the most reliable 5G network with the fastest 5G speeds and best 5G coverage, according to a report by umlaut. T-Mobile uses 600 MHz signals that travel further and provides more 5G coverage than its competitors.

In 2022, the company planned to add 6.3 million net customer additions for full-year 2022, overshadowing Verizon’s 12,000 additional customers and AT&T’s 813,000 additional customers.

How to Invest in 5G Stocks

As you can see, 5G technology is about much more than a faster mobile phone or tablet. This highlights one of the key benefits of investing in 5G stocks: diversification. Investing in 5G gives investors exposure to a wide range of sectors. And many of these sectors are among the hottest sectors in the stock market.

Of course, this does add an element of risk to 5G stocks. And one way to manage that risk is to invest in exchange-traded funds (ETFs) that track an index of 5G-related stocks.

There aren’t ETFs that title themselves as a “5G ETF.” However, by looking at the areas most likely to benefit from 5G, you can fine several ETFs that would provide you with good exposure. Some choices would be the Global X Internet of Things ETF (NASDAQ: SNSR) and the Defiance Next Gen Connectivity ETF (NYSEARCA: FIVG).

If you’re looking for even less risk, you can look at an ETF that focuses on the infrastructure behind 5G. For example, there are several ETFs that focus on semiconductors.

Pros and Cons of Investing in 5G

Investing in 5G does come with both pros and cons you should consider before you invest. These considerations range from new technologies to the impacts of underlying economic climates and consumer sentiment.

Pros of Investing in 5G

What are the benefits of investing in 5G? Let’s take a look:

- Affordability: 5G stocks are more affordable due to the technology bear market.

- Diversified: 5G stocks are also involved in complementary products and services so investors are somewhat diversified.

- Artificial intelligence (AI) applications: AI applications will become more efficient as 5G makes it possible to collect more robust data in real time to enable device-to-device (D2D) and machine to machine (M2M) communications.

- Efficiency: 5G is an enabling technology that will make data-heavy and mission-critical applications more efficient and mainstream from precision farming (agriculture technology) to smart cities and autonomous vehicles.

Cons of Investing in 5G

Investing in 5G includes the following downsides:

- Risky in weak economies: 5G investing can be risky in recessions and weak economic climates as companies cut capital expenditures and consumers cut down on expenses like upgrading to a 5G-enable smartphone or 5G wireless plan. Uncertain economic climates can also result in slower 5G infrastructure spending, buildout and adoption.

- Expensive to build: Financing 5G infrastructure buildout can be prohibitively more expensive with rising interest rates

- Exports: A strong U.S. dollar can hurt 5G companies that export products overseas.

The Final Word on Investing in 5G Stocks

If it seems like technology is expanding even faster than just 10 years ago, you can attribute it in part to the emergence of 5G technology. The words “revolution” and “paradigm shift” are thrown around and frequently, incorrectly. But that’s not the case with 5G.

For many investors, 5G is a game changer and the technology is still in the early innings of what it will be by 2025 and 2030. The promise of 5G is only just beginning to manifest itself in our homes and businesses. But many of the technologies that were enabled with 4G were brought to market because of the knowledge that 5G was coming.

This gives investors two very important things: time and multiple paths to profit. That’s an enticing combination and one that you would do well to capitalize on.