But what are defense stocks, and which type of military stock should you invest in? We will review how to invest in defense stocks in this article to bring you up to speed.

What Are Defense Stocks?

First, refrain from confusing "defense" stocks with "defensive" stocks. Defensive stocks are low-volatility, stable stocks that usually provide dividends to weather a market downturn better.

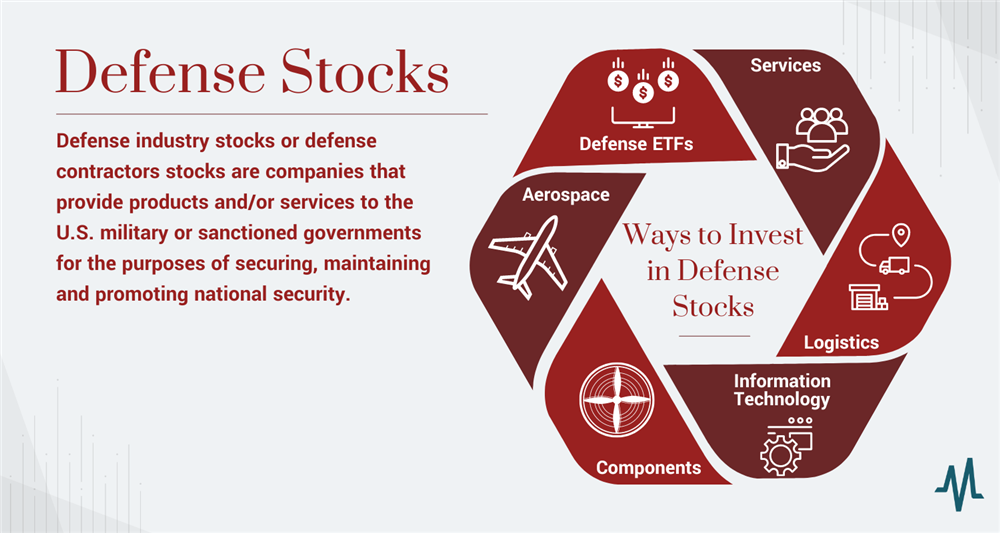

Defense industry stocks or defense contractors stocks are companies that provide products and/or services to the U.S. military or sanctioned governments to secure, maintain and promote national security. These can range from weapons, aircraft, ammunition, intelligence, data analysis and logistics services. Defense contractors have always been involved in every U.S. conflict or war and are the weapons suppliers to the U.S. government, usually contracted through the Department of Defense. Defense companies are banned from dealing with nations deemed hostile and must be approved by the U.S. government.

Ways to Invest in Defense Stocks

Since there are no actual war stocks since the U.S. military is not publicly traded, investors have only to invest in defense contractors that are publicly listed. There are many ways to approach investing in defense stocks. While many large defense contractors offer services throughout many segments of the defense industry, you can invest in companies specializing in various segments. Some defense contractors are so large that they have many divisions specializing in the following areas, thereby making the investment in the stock a diversified one.

Defense ETFs

If you want broad exposure to the defense sector, then a defense-themed ETF would be the best way to diversify investment in defense contractors. ETFs trade like stocks, so they can be conveniently bought and sold without the delay you would have in a mutual fund. ETFs are professionally managed, so you don't have to worry about researching and staying up to date on the happenings of any individual defense contractor.

Aerospace

You can also select a segment of specialization for defense contractors. The aerospace defense contractors focus on companies that make aircraft for military and commercial use. They may manufacture airplanes, fighter jets, air carriers, drones, satellites, and advanced combat aircraft. These stocks also tend to make aircraft for airlines for commercial use.

Components

These companies supply military equipment components like jet engines that go into fighter jets. Component companies are often subsidiaries of defense contractors, making them vertically integrated conglomerate organizations. Often, defense contractors are formed through a merger of companies providing complementary products and services, like a company that makes components for jet fighters, with a company that constructs the actual aircraft.

Services

This segment focuses on providing services from meal supplies to contracting special contractors for private armies and protection. It could include special contractors to provide assistance and backup for military operations involving ex-military members. Many of these contracts are classified and require high levels of clearance from the Department of Defense.

Logistics

This segment focuses on helping to transport military equipment and personnel. These companies secure the delivery of machines and people to and from war zones or military operations worldwide.

These companies provide the hardware and software to perform intelligence operations and data analysis. This includes data storage, analysis, management and artificial intelligence (AI) platforms. The information is highly sensitive and classified, often associating these companies with covert operations. While these companies are publicly traded, they access highly private and sensitive data and information that can be crucial for national security. These technology companies may also specialize in other enterprise data management functions for commercial clients.

How to Invest in Defense Stocks

Like any form of investment, there are specific steps to take to make sound investment decisions. If you decide to invest in a defense stock, it pays to research and plan ahead to ensure a positive experience. The best defense stocks may be wrong for your investment or risk profile, so consult an investment professional if you have any questions or concerns.

Step 1: Determine which segment to invest in.

As aforementioned in the previous section, there are many segments in the defense industry. Determine which segment or segments you want to include in your investment. You can select companies specializing in one or more interest segments ranging from aerospace and components to services, logistics and information technology. Some companies are conglomerates that include parts of all the segments. It's best to narrow it down to the segment you understand best.

Step 2: Select potential stocks.

You can run a scan on defense stocks through any broker platform or Google to compile a list of potential defense stocks to invest in. Make sure you have a familiar group of stocks — you will need to filter them to narrow the list down to the one or few that meet your criteria.

Step 3: Research fundamental factors.

Consider reading through several annual and most recent quarterly earnings reports to gauge the company's performance. This means knowing the top and bottom line growth rate, its debt structure and any recent news or material events such as large contracts. Be aware of what the company is known for and its operations. The fundamentals are the qualitative factors of the company and stock valuation. It also pays to compare various metrics with its peers and industry to determine if the valuation is low or high. Compare price-earnings, price-book, debt-equity, price-sales and year-over-year (YOY) revenue and earnings per share growth. For example, if the average price-earnings multiple is 25x and your stock is trading at 15x earnings, the stock may be undervalued and provide more upside potential. This is one way to find undervalued stocks to invest in.

Step 4: Research technical factors.

Technical research involves analyzing the underlying stock price history on a chart. While you don't have to be a chart expert, it does help to be able to identify if the current price is in an uptrend or downtrend, as well as support and resistance levels. If you plan to invest long term, you can look for weekly and monthly trends, support and resistance levels. Daily and hourly charts can be used for those with shorter-term investment horizons.

Stocks in an uptrend usually command a premium as more buyers than sellers create more robust demand over supply, which drives up the stock price. Consider an entry if the fundamentals are strong enough to justify more upside. Otherwise, it might be better to wait for a pullback.

Downtrending stocks have more sellers than buyers, but it can be due to a bear market, not the individual company. Downtrending stocks are cheaper because you take on more risk with a falling stock price, but the rewards can be better when the trend reverses.

Step 5: Determine your entry and exit price levels.

When you can identify the trend, support and resistance on any stock, you can use them to determine your entry points. For an uptrending stock, you may buy it on a pullback to a trend support price level. You may also sell the position at a price resistance level and thereby sell into strength rather than in a panic when prices drop. For downtrending stocks, you might wait for the stock to reverse its trend before entering a position. You can also predetermine an entry based on a price support level and place a limit order in case it triggers when you aren't watching. Either way, it pays to prepare and predetermine your investment entry and exit price.

Will Conflict Move Defense Stocks?

Conflicts that make headlines tend to move defense stocks depending on the specifics of the news. Wars tend to immediately bolster stocks in the defense sector in anticipation of the vast sums of money expected to be spent buying military equipment such as weapons systems, ammunition, devices, and vehicles. However, be careful not to chase prices when these stocks shoot up rapidly.

Remember that you are not the first to spot these stocks and professional money managers are miles ahead of you. In many cases, defense stocks may actually tumble on news of war because they already ran up in anticipation of the event that a "sell the news" reaction happens. This is why it pays to do both fundamental and technical analysis before jumping into a defense stock. Never impulsively jump in head first with any stock, especially in the defense industry.

The defense industry is considered to be recession-proof. National security is a top priority for the U.S. government; when conflict arises, it spares no expense to protect the nation. The stability of the U.S. government and its spending on defense provides stability for defense stocks.

Most defense stocks pay a dividend and the larger defense contractors are the definition of blue chip stocks that have stood the test of many bear markets and economic recessions. Defense stocks can be conservative lower-risk investments compared to biotech stocks that generate income through dividends, especially during market downturns.

The Best Defense is a Good Offense

Defense stocks generate most of their revenues from the U.S. government through military contracts through economic expansion and tightening cycles. Like healthcare and utility stocks, defense stocks are generally recession-proof, as defense is a national priority.

These are consumer staples, not consumer discretionary stocks, to invest in. They aren't nearly as volatile as the FAANG stocks. While everyone tends to focus on defense stocks when a war or global conflict breaks out, it pays to play offense during peace and low geopolitical conflicts to get positioned before things erupt.

Once war or conflict break out, defense stocks will have already spiked to premium levels. It pays to be early or wait for pullbacks to enter defense stocks.