Key Points

- Meta Platforms had a Cinderella quarter, delivering everything the market wanted.

- The company issued its first-ever dividend, and it is highly likely to continue to pay and make annual increases.

- Meta Platforms is on track to hit a $2 trillion valuation soon.

- 5 stocks we like better than Meta Platforms

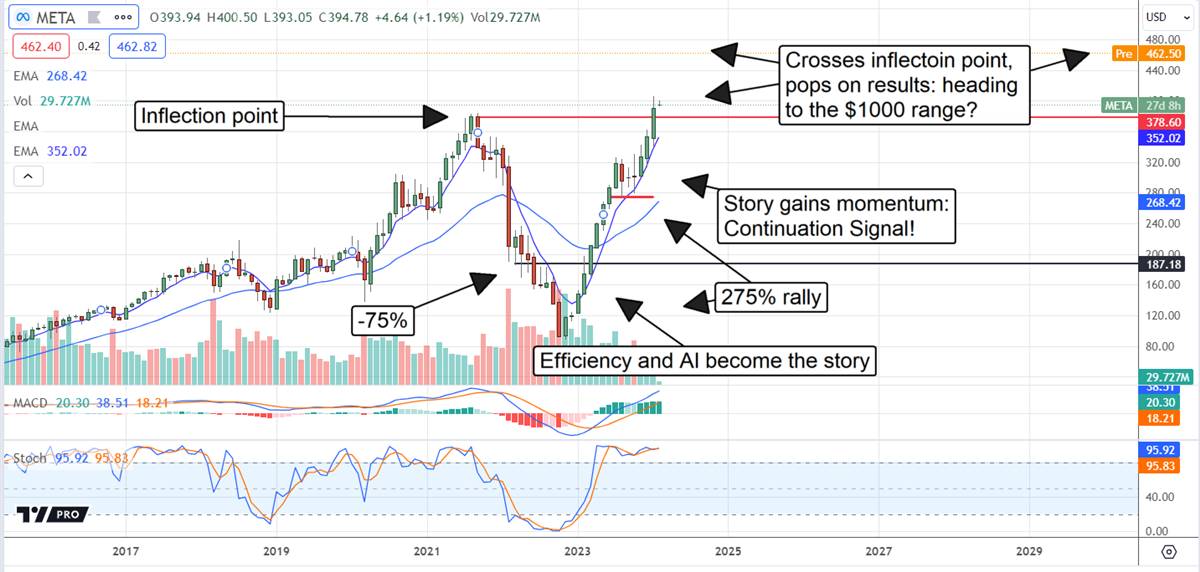

Meta Platforms NASDAQ: META still has a long way to go to double its valuation from the pre-Q4 release market cap, but it is on track to hit a $2 trillion valuation. The company’s leaning into efficiency, its use of AI, and its loyal and growing fanbase continue to pay off for investors, and the story is only improving. The Q4 results were good enough on their own, the guidance icing on the cake, but the decision to pay dividends has this stock up 15% in premarket trading and likely headed higher over the near, short, mid and long terms.

What does the dividend do for Meta? Lots. The dividend sends a signal of stability and maturity to the market, and it is coming from a vigorously growing tech company. Other tech companies that have used dividends to help leverage their valuation above $2 trillion include Apple NASDAQ: AAPL and Microsoft NASDAQ: MSFT, valued in the $3 trillion range. Microsoft, at least, is on track to hit $4 trillion. Other candidates include Alphabet (NASDAQ), Amazon NASDAQ: AMZN, and NVIDIA NASDAQ: NVDA, but Meta scooped them all. Its payment aligns with Apple and Microsoft and is even safer with a more robust outlook for growth.

Meta’s board approved the first-ever dividend at $0.50 per share. That annualizes to $2.00 or about 0.4% compared to the 0.5% paid by Apple and the 0.75% by Microsoft. We have to assume that Meta will pay a regular quarterly dividend and make annual increases, but it is unlikely to do anything different. Microsoft has increased for over twenty years, and Apple has increased by more than ten.

The fact it pays dividends opens potential ownership to all the funds and investment plans that may only invest in dividend-paying stocks. Annual increases attract buy-and-hold investors, and the outlook for increases is solid. The $2.00 annualized payout is less than 15% of the earnings, aligning with Apple and better than Microsoft. The balance sheet is sound, and earnings growth is in the forecast.

Meta Platforms has a Cinderella quarter

Meta Platforms had the absolute best quarter it could have regarding the market, its expectations and the outlook for future results. The company reported $40.11 billion in net revenue for a gain of 24.7% YOY, beating the consensus by 240 basis points. The strength was aided by an FX tailwind, which accounts for the strength. Even so, the as-expected 22% growth is good and compounded by a widening margin, capital returns, and guidance.

Internal metrics are also favorable. The company grew daily and monthly active users across the board, with strength in MAUs outside of Facebook. The user growth is slim in the mid-to-high single-digit range but compounded by ad penetration. Ad impressions are up 22%, and revenue per ad is 2%, creating one of the two tailwinds leveraging the bottom line results. The other is efficiency. The company lowered its costs by 8% on a 22% decline in headcount to more than double the operating margin and increased net income by 200%. Lean operations are expected to continue this year.

Guidance speaks for itself. The company expects revenue from $34.5 to $37 billion in Q1. That’s growth of 20% compared to last year, showing growth is accelerating going into 2023.

Repurchases help lift Meta stock to new highs

As if there wasn’t enough good news in the Meta report, it also raised the share repurchase allotment. The company bought back $20.03 billion worth of common stock in Q4, has $30 billion left under the current authorization and raised the plan by $50 billion, leaving $80 billion available, about 8% of the pre-release market cap.

The only thing that may hold Meta share prices back is the analysts. The analysts raised the consensus by 85% YOY but it lags behind the new highs at the high end of the target range. The analysts have been slow to issue revisions, but they will likely raise their targets and the consensus; the question is how much and where the new ceiling will be.

Technically speaking, there is a case for Meta shares to advance by a high triple-digit figure over the next few years, maybe quicker. The market made a significant correction in 2021 and 2022 but recovered the losses nicely, setting a trading range that has been broken. The stock hit a critical pivot point when it crossed new highs in January and may advance by the range magnitude now that the pivot is confirmed. Additionally, the rally in 2023 is strong and shows a continuation signal that has yet to play out.

Before you consider Meta Platforms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meta Platforms wasn't on the list.

While Meta Platforms currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to pot stock investing and which pot companies show the most promise.

Get This Free Report