Boring, in other words. However, utilities can still have a place in the portfolios of risk-averse investors looking for safety and yield. In this article, we'll break down the utility stocks and discuss which types of investors should consider companies in this sector.

Overview of the Utilities Sector

Utility companies are the firms people only pay attention to if they're not working correctly. When you turn on the air conditioner, fill up the water pitcher or take out the trash, you don't think about the stocks of the companies providing these services. You may think about them when you pay the bill, but these companies usually fly under the radar. Investors treat them similarly.

The utilities definition is one of a defensive sector since the demand for power and water is inelastic and the industry is heavily regulated. Despite being private companies, the National Association of Regulatory Utility Commissioners (NARUC), oversees them and guarantees that utility services "are provided at rates and conditions that are fair, reasonable and nondiscriminatory for all customers."

Why Invest in Utility Stocks?

Investing in even the best utilities stocks is a challenging path to quick riches. Due to heavy regulations and unfluctuating demand, companies in the utilities sector have limited opportunities to score outsized profits. Moreover, since these companies provide public amenities that all Americans require, utilities must follow specific rules to ensure that all communities and areas have access to comparable service levels.

So why invest in a sector that doesn't seek to maximize profits? Safety and security are the two primary answers. Utilities stocks are low-beta companies and are less volatile than the overall market. Utilities are some of the least volatile stocks in equity markets. Plus, utilities provide security in the form of stable dividends, usually higher than those paid by companies of similar volatility (and often higher than U.S. Treasuries). As a result, low-volatility stocks with quality dividend payouts are often desirable to less risk-averse investors, especially during economic turbulence.

Types of Companies in the Utilities Sector

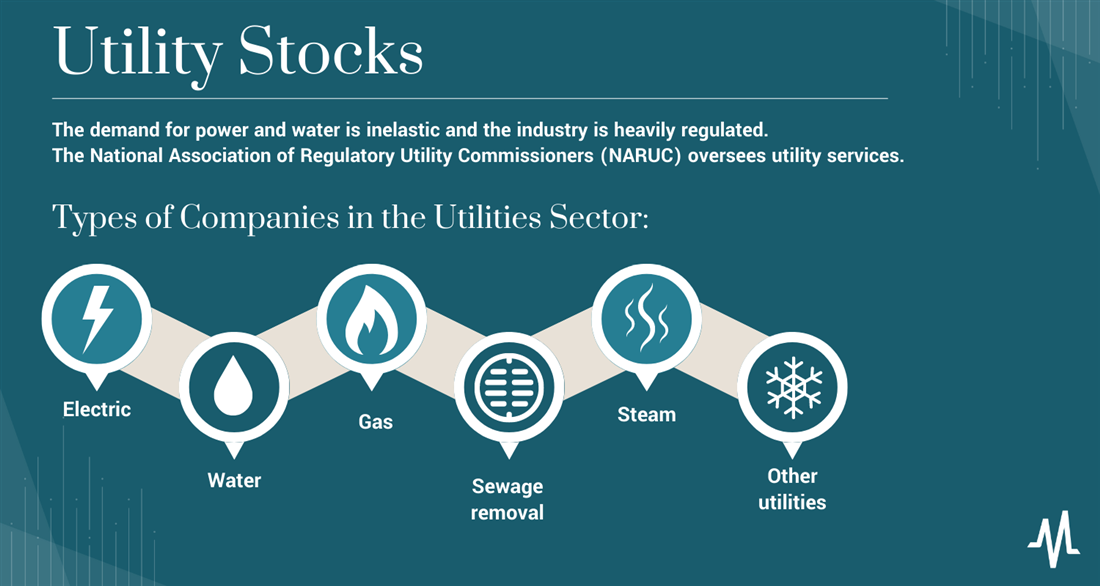

While the companies in the utility sector are privately owned, they're subject to some of the most stringent regulatory oversight. Since utility companies are responsible for providing American citizens with basic amenities, federal, state and local governments are active in this sector to ensure that affordable and efficient service is available to everyone. According to the Bureau of Labor Statistics, utility providers can be broken down into five types of utilities examples and services (although many companies specialize in more than one type).

Electric Utilities

Utility companies in the electric industry are responsible for maintaining power grids and providing electricity to homes, businesses and public places. Many power companies we receive monthly bills from are under the umbrella of large publicly-traded companies. For example, Exelon Corp. (NASDAQ: EXC) is a vast electric company that counts PECO, Commonwealth Edison and Potomac Electric Power Company as subsidiaries.

Water Utilities

Imagine a life without running water. Not only is water required to sustain our existence, but we use it for cooking, cleaning, bathing and flushing waste. Water utilities are responsible not just for providing water supply to public infrastructure, but they also must ensure its cleanliness. the Environmental Protection Agency (EPA) heavily regulated water utilities to guarantee clean and safe to all communities and industries. American Water Works Co. Inc. (NYSE: AWK) is one of the country's most prominent publicly traded water utilities.

Gas Utilities

Natural gas is another commodity that many families and businesses rely on. Power plants can use gas to generate electricity, but most consumers use it for heating. For example, people use gas stoves to cook and boil water, and many heating and cooling systems (and other appliances) use natural gas as fuel. Gas utilities are often part of electric utility companies like Centerpoint Energy Inc. (NYSE: CNP).

Sewage Removal Utilities

One of the best utility examples we take for granted is sewage and waste removal. Removing and treating wastewater is one of the essential public services offered by utilities, whether it's sewage from flushing toilets, overflows from storms and inclement weather or excess water from sinks, showers or outdoor hoses. Sewage removal utilities often work hand-in-hand with water suppliers to ensure proper treatment. One example is the American States Water Co. (NYSE: AWR).

Steam Utilities

When water converts to gas, the resulting chemical is steam. Steam has many industrial and consumer uses, such as heat, cooking, cleaning and energy storage. Steam has become increasingly important in renewable energy systems as well. Brenmiller Energy Ltd. (NASDAQ: BNRG) is a company that utilizes steam and hot air to create energy storage systems.

Other Utilities

Utilities can be a mix of public government-run companies, mixed cooperatives owned by customers and clients or private companies overseen by public regulators. Increasingly, phone and internet service are a utility since most Americans need affordable and efficient communication services to perform daily functions at school, work and in their personal lives. However, the Bureau of Labor Statistics doesn't yet consider telecommunications services in the utility sector, so we'll leave it as a footnote here.

How to Trade and Invest in Utilities

So what are good utility stocks? The answer depends on your goals and time frame as an investor. Utilities have minimal volatility, which doesn't make them ideal for a short-term trading operation. Investing in utilities stocks usually means investing for the long haul or capital stability instead of appreciation.

Step 1: Think of your long-term goals.

Before investing in utilities, consider your goals as an investor. If you want to make quick profits, you'll likely find better options in other sectors, like tech, consumer discretionary or even energy stocks. An investment in utility stocks could be worthwhile if you have a long-term mindset, like a retirement saver looking to earn a steady dividend income.

Step 2: Research different utility companies.

While all utilities are heavily regulated, not all companies have the same balance sheets, debt levels or long-term prospects. So you'll need to research the different companies in the sector and choose the ones that best fit your investment goals and plans.

For example, if you're looking for utility companies that pay good dividends, use the MarketBeat Dividend Screener to locate stocks with sustainable dividend payouts. In addition, you can look for companies in the diversified utility sector or narrow your search to companies strictly dealing with electricity, water supply or even renewable energy providers.

Step 3: Set aside capital for your utility portfolio.

When carving out space for utilities in your portfolio, remember these stocks will likely be the most conservative equities you purchase. Consider the level of risk you want in your equity investments and use the capital for utility stocks based on those guidelines. Even relatively safe stocks like utilities suffer from occasional volatility, especially when interest rates rise.

Step 4: Purchase shares of desired utility stocks.

Once you have your investment plans laid out, you can buy the shares of the companies you want in your portfolio. Utilities stocks tend to move in lockstep, so low-cost ETFs like the Utilities Select Sector SPDR Fund (NYSE: XLU) are a popular way to invest in the sector. First, find the shares you want through your brokerage account and buy them for your portfolio.

Step 5: Keep track of your investments and monitor For regulatory actions.

If you buy a diverse group of utility stocks (or an ETF), the day-to-day market movements may not matter much since you'll keep them for long-term viewpoints, nor do you purchase utilities for overnight riches. However, you'll still need to track your investments and rebalance your portfolio when appropriate. You'll also need to keep track of current events and regulatory actions, especially with the push for renewables underway.

Pros and Cons of Investing in Utility Companies

Before looking for the top utility stocks for your portfolio, you'll need to consider the benefits and drawbacks of the sector. Here are a few pros and cons to keep in mind when doing your research.

Pros

On the "plus" side, consider that the best utility stocks and companies:

- Offer more safety than most equity sectors: While all stock investments carry some level of risk, utilities are often considered the least volatile equity sector since the demand for their services stays relatively level. In addition, these companies are often older firms that pay high dividends, so they're frequently popular with retirees.

- Often outperform in bear markets: When bear markets occur, it's usually bad for every sector. However, utilities tend not to drop as much as other sectors when markets decline, making them a popular haven in times of trouble.

- Offer high dividends: Utilities tend to pay better dividends than other stocks in the market. As of this writing, the XLU ETF has a dividend yield of 3.07%, while the average dividend yield of the S&P 500 is 1.74%.

Cons

Now, the downsides:

- Limited upside in bull markets: Low volatility works both ways, and investors in utilities may miss out on some upside during bull markets.

- Heavily regulated: Since utilities provide necessary public goods, regulation plays a heavy role in corporate governance. As a result, you'll need to know the decisions and mindsets of local, state and federal regulators.

- High interest rates hurt utilities: Since utilities are considered a conservative investment, they often compete with bonds for investor capital. Therefore, bond yields become more attractive when interest rates rise than utility stock yields. High interest rates also hurt utilities since the infrastructure is expensive to finance, and many companies carry heavy debt loads.

Future of Utilities Investing

For the first time in a while, the utility sector could be on the verge of massive change as renewable energy initiatives are rolled out both in the United States and in countries abroad. However, high inflation and interest rates are still headwinds you can consider before investing in the sector. So, for now, utilities will likely remain a conservative investment strategy for those looking for stocks with high dividends and minimal volatility.

Utility Companies Often Have Low-Risk, Low-Reward Stocks

Utilities provide essential services to nearly every person and business in the country. Without clean water and electricity, daily life would cease functioning, so these companies must be well-run and efficient. However, despite these firms' necessity, their stocks are often overlooked. The utilities industry face stringent regulation that limits profits and their infrastructure requires plenty of capital and workforce. As a result, conservative investors looking for dividend income tend to flock to utilities, but those with higher risk tolerances look elsewhere.

FAQs

Here are a few commonly asked questions about investing in utilities.

What is considered a utility stock?

A utility stock is a company that provides a basic public amenity, such as electricity, water supply or sewage removal. Since these services are necessities, utilities are regulated heavily at the state and federal levels.

Are utilities a good stock investment?

Utilities can be suitable stock investments if they fit your goals and mindset. For example, utilities are ideal for risk-sensitive investors who want to earn income through dividends. But on the other hand, if your goal is short-term profits through volatility, utilities will likely fail to meet your parameters.

Are utility stocks risky?

All stock investments carry some element of risk, which some sectors being less volatile than others. For example, utility providers have stocks with low volatility and are often considered one of the “safest” sectors to invest in.