The company and its underwriters must find the "Goldilocks" zone between issuing too many shares or not enough during the initial offering. They also must decide whether or not to have a stock lockup period, which prevents insiders from selling shares on public exchanges for a certain length of time. This article will discuss how an IPO lockup period works, why it's used and whether it meets its intended goals.

What is a Stock Lockup Period?

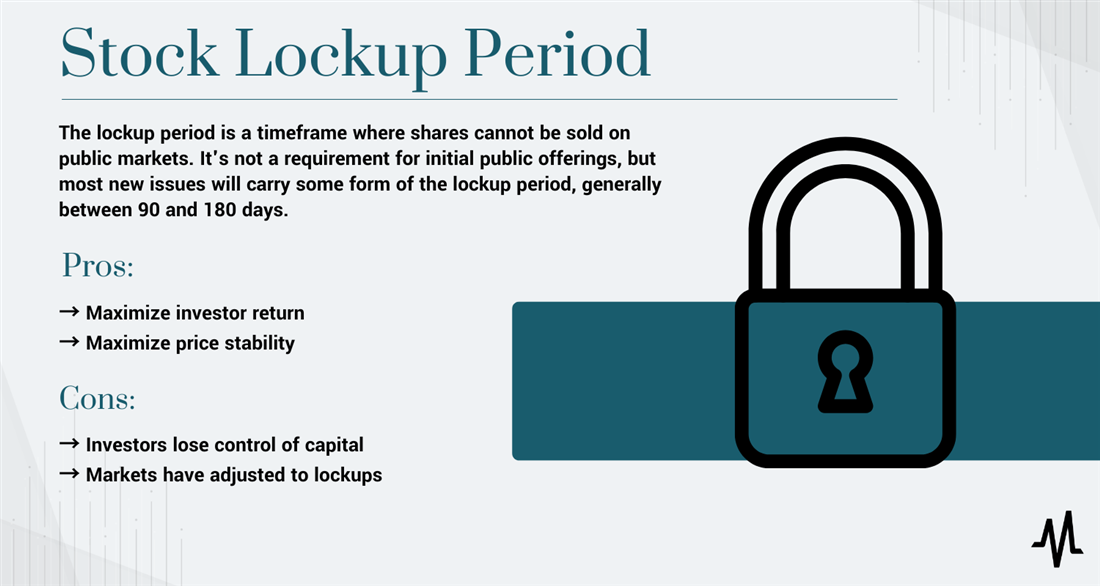

The lockup period is what it sounds like — a timeframe where shares cannot be sold on public markets. It's not a requirement for initial public offerings, but most new issues will carry some form of the lockup period, generally between 90 and 180 days. But the IPO lockup period should really be considered an insider lockup period since only shares acquired before public trading began are subjected to it.

For example, if you log into your brokerage account and buy shares of a newly-listed company on a public exchange, you don't have a lockup on your shares. You can buy and sell as freely as you wish on public exchanges. But if you requested and acquired your shares before they were listed on public exchanges, you might have restrictions on when you can sell.

The lockup period usually hits institutional investors like hedge funds or asset managers (along with company employees going public) instead of individual or retail investors. Retail traders often don't have access to upcoming IPO shares before they hit public exchanges, so most institutions possess shares. The stock's prospectus must disclose any lockup period before going public.

Additionally, there could be different lockup lengths for different types of investors. For example, a company might decide to release executives and employees from a lockup period at a certain date, followed by hedge funds and venture capitalists at a later date.

Why is a Lockup Period Necessary?

Lockup periods aren't required by securities law, and some companies do agree to go without them, but this is rare. Most companies and their insiders agree that a lockup period is beneficial because restricting insider sales will prevent early investors from immediately cashing out. If insiders were to cash in their profits at once, not only would the share price suffer, but it would demonstrate a lack of faith in the company that could spook potential new investors.

Requirements of a Company Lockup Period

Lockup agreements are almost universal in IPOs, but aren't required by the SEC or any authoritative body. However, companies do need to follow some legal guidelines if they want to institute one. For starters, details on the lockup period must be available in the documents the company registers with the SEC, including the prospectus (which IPO investors should read thoroughly anyway).

Information on the lockup must include how long the agreement last and who's subject to its restrictions. Are all insiders subject to the same lockup length or do executives have an earlier release date? A 180-day lockup period used to be the most frequently used version, but recent, 90-day lockup periods have been rising in popularity. If insiders can sell a limited number of shares during the lockup agreement, it must also be clearly spelled out.

Understanding the Significance of a Quiet Period

The quiet period stands in contrast to the lockup period, but both are crucial timelines to be aware of if you're an IPO investor. The quiet period limits buying instead of limiting selling like the lockup period.

Why would a quiet period be needed where buying is limited? The quiet period prevents insiders from accumulating more shares in anticipation of news releases or IPO announcements. During the quiet period, insiders cannot buy new shares or release any information about the company to the public. And unlike the lockup period, the quiet period IS required by law when companies begin submitting documents to the SEC.

When Insiders Can Sell Shares

If a lockup period is in place, insiders must wait until it expires before unloading shares on the public exchanges. Some lockup periods have modifiers stating that insiders may sell some shares before the restriction ends, but usually only employees and the earliest investors can do so.

When the lockup period ends, insiders are allowed to sell shares that day. For example, if the lockup is 180 days, insiders can start selling stock on the 181st day following the IPO.

Do stocks drop after lockup period due to insider selling?

Yes, they do!

Research has shown that stocks, on average, suffer a 1-3% decline in price following the end of lockup. This is even more pronounced in some cases, like when Uber Technologies Inc. (NYSE: UBER) dropped over 40% after disgruntled insiders flooded the market with shares following the lockup expiration.

Pros and Cons of a Lockup Period

Companies and investors generally understand why the lockup period is used, but this practice has benefits and drawbacks. Here are a few items investors should be aware of when considering IPOs.

Pros

The benefits of a lockup period include:

- Maximize investor return: Early-stage investors take on a lot of risk when buying shares not currently on public markets. Since private shares are illiquid and difficult to value, these early-stage investors want some incentive to take that risk, and a lockup period prevents later investors from dumping shares as soon as the company goes public.

- Maintain price stability: Imagine if all insiders could sell previously private shares immediately after the stock goes public. Rampant selling would hurt the company's reputation, and the price would become unstable as insiders and institutions hold more shares than become available to the public in an IPO.

Cons

The downsides include:

- Investors lose control of capital: A stock lockup period means that investors must have their capital tied up in a position for three to six months, which is an opportunity cost should better potential investments arise. If the company suffers a scandal, insiders must continue holding even if the share price plummets.

- Markets have adjusted to lockups: Most investors believe markets are either incredibly efficient or somewhat efficient (depending on your view of the efficient market hypothesis). Regardless of your viewpoint, it's clear that markets have baked in the effects of a lockup period. Newly-issued stocks frequently drop 1% to 3% on average as the expiration date of the lockup period grows near.

Example of a Lockup Period

What is a lockup period in stocks? Here's an example of a lockup period stock close to ending its restrictions: Skyward Specialty Insurance Group Inc. (NASDAQ: SKWD), which went public on January 13 — its lockup period will expire on July 17.

SKWD is a stock to watch because it's been very successful following a mid-March dip and currently trades well above its IPO price of $15. When the lockup period expires, will institutional investors take profits and cause the share price to drop in line with the usual lockup expiry dip?

Are Lockup Periods Effective?

The effectiveness of lockup periods can inspire some heated debates. Some companies and investors claim the lockup period is crucial for maintaining price stability and preventing insiders from trading on non-public information. By preventing insiders from selling, the stock looks strong to newer potential investors and the price remains attractive for an extended period following the IPO.

Conversely, some investors claim the lockup period is fruitless because market participants who buy on exchanges will simply sell their shares before the lockup period expires. This often results in a stock price drop in the days preceding the lockup expiration as market timers anticipant the insider selling spree and unloading shares beforehand,

Understanding Lockup Periods is Crucial for Any IPO Investor

The efficiency and effectiveness of IPO stock lockup periods are fiercely debated on Wall Street. But no matter which side of the coin you fall on, it is important to understand how IPO lockup periods work, who they're usually in place for and how they affect the security price in the near future. Market timers often short a stock before the IPO lockup period expires, hoping to snatch gains from the drop that often follows insider selling.

Of course, markets tend to be rational, and insiders could counter this lockup selling wave by buying MORE shares as the date approaches. If a 1% to 3% drop may occur, institutions could also wait for that decline and then purchase shares at a discount, which would reverse the earlier price movement.

Confused yet? Well, markets aren't easy! Trading IPOs is a tricky practice and not recommended for newer investors. However, it's still important to understand the lockup and quiet period concepts before diving into a newly listed stock.

FAQs

What is a lockup period in stocks? Here are a few important questions about lockup periods and how they impact the price of a newly-issued asset

What happens after the lockup period?

When the IPO stock lockup period expires, insiders, hedge funds, venture capitalists and other institutional investors who acquired shares early can begin selling them. The lockup period generally only affects insiders who got their shares directly from the company and not via public exchanges like the NYSE or NASDAQ.

When the lockup period expires, what commonly happens to the share price?

When insiders can begin selling, many choose to reduce their positions, especially if they're sitting on large profits from early investments. But markets anticipate this selling wave, so new stocks tend to decline between 1% and 3% on average as the lockup period expires.

Why is there a lockup period after an IPO?

The IPO lockup period prevents insiders from immediately cashing out on public exchanges, which not only helps the stability of the IPO's stock price but also shows faith and conviction in the new publicly-traded company. An immediate wave of insider selling could crater the share price below the initial IPO price, which would cause hesitation amongst market participants and significantly slow demand for the new stock.